Render’s (RNDR) Futures Traders Close Out Existing Positions

The poor market performance last month has impacted the price of the leading artificial intelligence-based token Render (RNDR).

This has led to a decline in activity in its derivatives market.

Render’s Futures Open Interest Plummets to Monthly Low

At press time, Render (RNDR) trades at $7.62. The low market activity in the last month has caused a 26% value decline.

This price fall has forced many traders out of its futures market, as evidenced by its declining futures open interest, which is set to close in June at a monthly low.

As of this writing, RNDR’s futures open interest is $132 million. It has fallen by 35% since the beginning of the month.

An asset’s futures open interest measures the value of outstanding futures contracts that have not been settled or closed. When it declines, it suggests that traders are closing their positions without opening new ones.

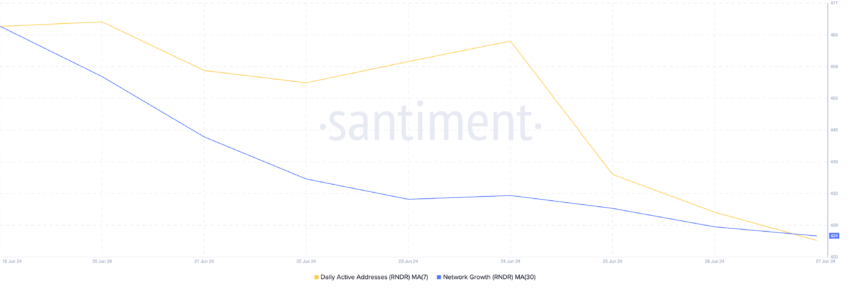

This is a bearish signal which connotes a reduction in market activity and traders’ interest. The fall in interest is seen in the decrease in RNDR’s daily active addresses and the new demand for the token.

Read More: Render Token (RNDR) Price Prediction 2024/2025/2030

Assessed using a 30-day moving average, the daily count of addresses involved in RNDR transactions has fallen by 11% in the last month.

Likewise, the new demand for the AI token has decreased. During the same period, the number of new addresses created daily to trade RNDR has dropped by 9%.

RNDR Price Prediction: Sellers Are Losing Their Grip

The decline in RNDR’s price appears to be losing momentum; hence, a potential rebound might be underway. According to readings from the token’s Aroon Down Line, its value is 28.57% as of this writing.

The Aroon Indicator identifies an asset’s trend strength and potential price reversal points. When the downline is close to zero, the downtrend is weak, and the asset’s most recent price was reached long ago. This is often regarded as a sign of a potential trend reversal.

If RNDR rebounds, it might rally to exchange hands at $7.91 or even past the $7 price level.

Read More: 5 Best Render Token (RNDR) Wallets for 2024

However, if the current downtrend continues, its price may fall to $6.67.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.