BlackRock’s Bitcoin ETF joins top 1% of ETFs by size, hits $40 billion milestone in record time

Key Takeaways

BlackRock’s Bitcoin ETF reached $40 billion in assets in just 211 days, setting a new speed record.

IBIT is now larger than all ETFs launched in the past decade, ranking in the top 1% by size.

Share this article

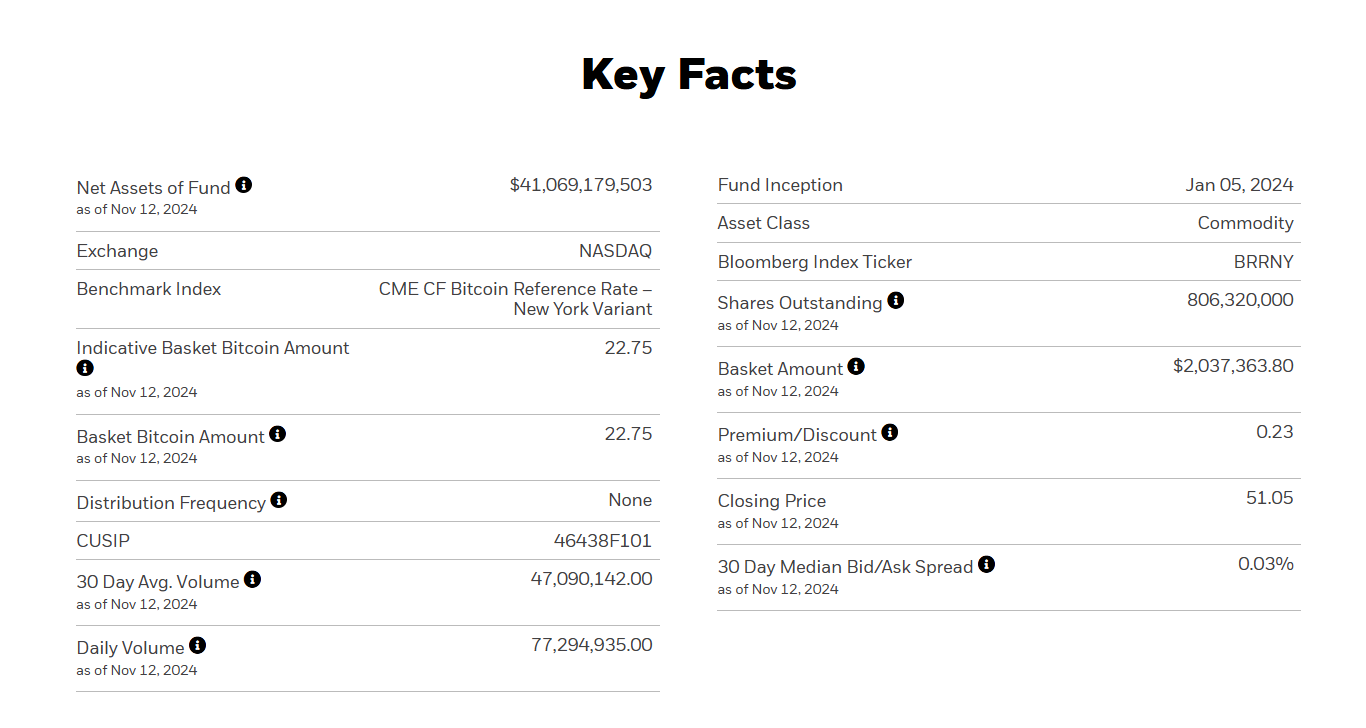

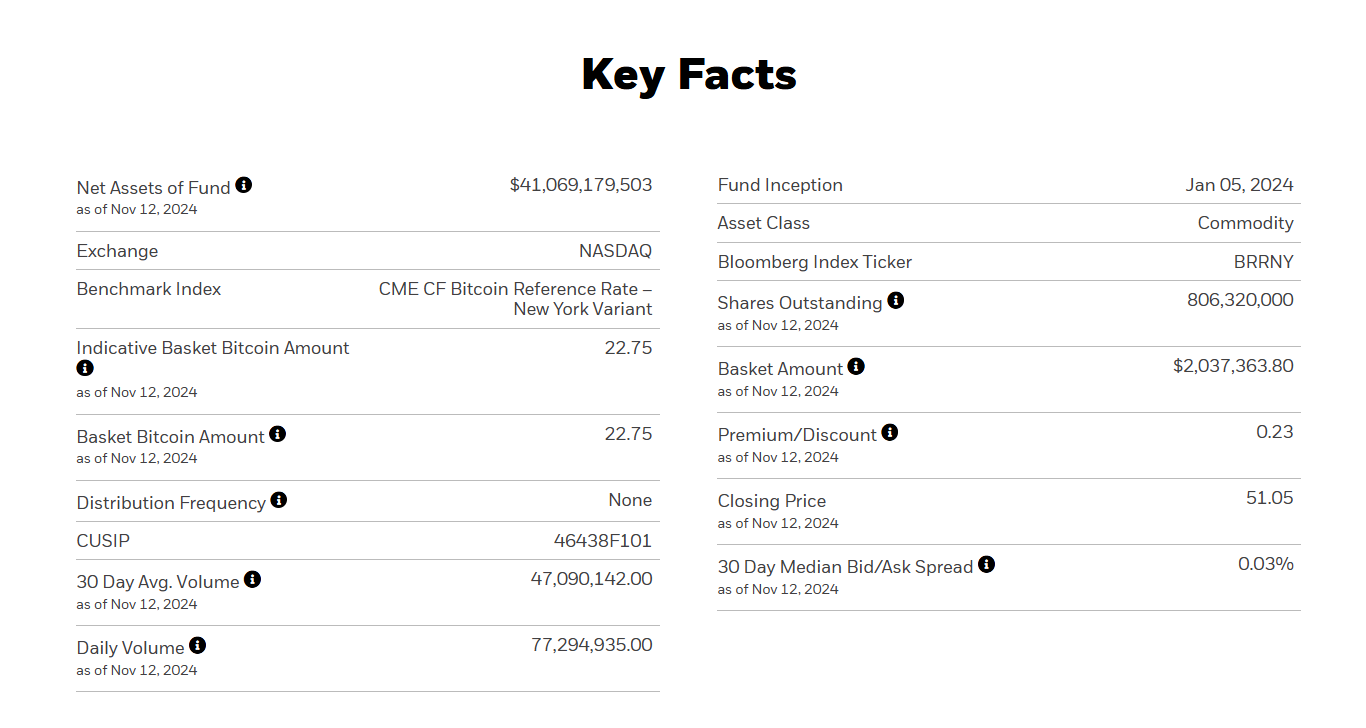

BlackRock’s iShares Bitcoin Trust (IBIT) has amassed $40 billion in assets under management just 211 days after its launch. The fund has ascended to the top 1% of all ETFs in terms of assets, outpacing all 2,800 ETFs launched in the past decade, said Bloomberg ETF analyst Eric Balchunas.

The achievement shatters the previous record of 1,253 days held by the iShares Core MSCI Emerging Markets ETF, a BlackRock-managed fund that tracks the investment results of an index composed of large-, mid-, and small-capitalization companies in emerging markets.

At just 10 months old, IBIT has also grown larger than its Gold ETF counterpart, the iShares Gold Trust (IAU), which currently holds around $32.3 billion in assets.

Since its January debut, IBIT has netted approximately $29 billion in net inflows, Farside Investors data shows.

The surge in Bitcoin’s price, fueled by factors like Trump’s election victory and potential regulatory changes, has driven demand for IBIT, as well as other Bitcoin ETFs.

Bitcoin just set a new record high of $93,000 at the time of reporting, per CoinGecko. The leading crypto asset has surpassed Saudi Aramco to become the world’s 7th largest asset, according to Companies Market Cap. The latest achievement comes just days after Bitcoin overtook silver’s position.

US Bitcoin ETFs on track to surpass Satoshi Nakamoto’s estimated Bitcoin holdings

The pace of Bitcoin ETF accumulation has accelerated following Trump’s reelection, with a massive $2.8 billion being poured into IBIT in the last four trading days. The group of US spot Bitcoin ETFs collectively attracted over $4 billion in net inflows.

In a Tuesday statement, Balchunas suggested that these funds are nearing the estimated Bitcoin holdings of Satoshi Nakamoto, potentially surpassing the creator of Bitcoin by Thanksgiving.

Market analysts expect continued inflows into Bitcoin ETFs, supported by the positive sentiment surrounding the crypto markets and potential future developments.

Share this article