Bitcoin sinks under $80,000, faces potential drop to pre-election levels

Key Takeaways

Bitcoin has dropped 21% from its all-time high, warned Wolfe Research.

Analysts suggest Bitcoin could fall to $70,000 if the $90,000 level isn’t reclaimed.

Share this article

Bitcoin hit a low of $79,500 on Binance on Thursday, marking a 26% decline from its January peak, as broader market risk aversion continues to pressure crypto assets.

The leading digital asset could retreat to $70,000 — a level not seen since Election Day — if it fails to reclaim $90,000, according to Wolfe Research.

A drop to the mid-$70,000 range is possible, Wolfe analyst Read Harvey warned, noting that a break below the key $91,000 support signals a bearish turn, and current price action is concerning.

“$91,000 acted as the floor over the past several months. With that level now decisively taken out, anything less than another V-shaped oversold response would send a very bearish message. So far not so good,” Harvey stated, as reported by CNBC.

If bearish sentiment intensifies, Harvey predicts prices could fully reverse to their pre-election levels.

President Trump’s decision to impose tariffs on major trading partners, including Mexico, Canada, and China, has ignited concerns about an economic slowdown, despite earlier optimism following the election, inauguration, and executive order on crypto.

When investors are feeling uncertain about the economy, they tend to de-risk, with consequences spanning stocks, commodities, and crypto assets, according to Harvey.

“Uncertainty is at the forefront of investors’ concerns and the willingness to take on risk is rapidly waning,” the analyst said.

“The crypto market is feeling the pressure, with both major and altcoins experiencing significant selloffs, and traders are responding by seeking safety over upside gains. In particular, the demand for downside protection has surged,” said Nick Forster, Derive Protocol’s founder, in a Thursday note.

According to Forster, the massive outflows from spot Bitcoin ETFs signal growing risk aversion among institutional investors. The exodus is fueling selling pressure across the crypto market, raising concerns about a potential negative feedback loop where cascading sell-offs further depress prices.

“The fear is that this could create a negative feedback loop, where continued selling drives more selling, further driving prices lower,” he said.

Trust issue

The crypto industry continues to face trust challenges despite regulatory progress and technological improvements, according to Magic Eden co-founder Jack Lu.

Recent weeks have seen positive developments in crypto regulation, including Congressional efforts to establish an industry framework. However, consumer confidence remains elusive amid ongoing security incidents and fraudulent schemes.

The Libra scandal has eroded trust among investors. Kelsier Ventures, led by CEO Hayden Davis, is now seen as a key player in a network of fraudulent schemes. The firm has been allegedly linked to multiple meme coin projects, including tokens like MELANIA and others.

Cybersecurity vulnerabilities are still a major concern, especially in light of the recent attack targeting Bybit. Even with regulation, the regulation itself is seen as less protective than traditional financial regulation, American University Washington College of Law professor Hilary Allen told Bloomberg.

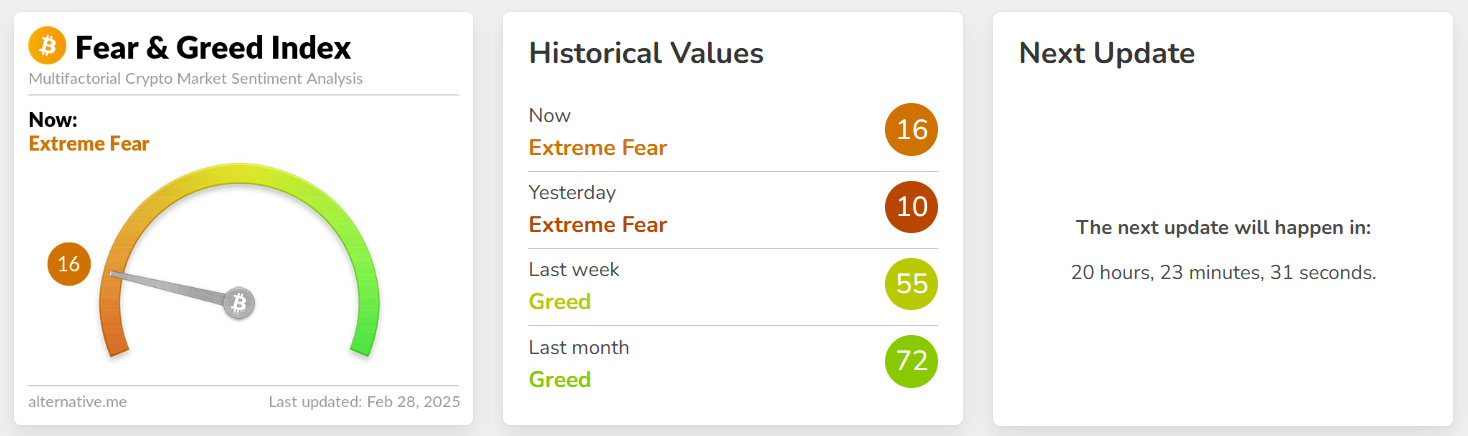

The crypto market’s total capitalization dropped below $3 trillion, a low not seen since November, and market sentiment, as indicated by the Fear and Greed Index, is still deeply pessimistic.

Share this article