POPCAT Price Crash Imminent, Time to Exit or What?

The popular Solana-based meme coin, Popcat (POPCAT) is poised for a notable price decline as it flashes bearish price action on the daily time frame. The meme token has gained significant attention from crypto enthusiasts in recent days due to its impressive performance.

POPCAT Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, POPCAT has been forming a bearish Head-and-Shoulder price action pattern on its daily time frame. This speculation follows today’s notable price decline of 7.5% from an earlier level, which now appears to form the first shoulder of the H&S pattern.

Based on the recent price action, if POPCAT experiences another price decline and reaches the $1.2 level, the pattern will be successfully confirmed. According to the meme coin’s daily chart, $1.15 appears to be the neckline of the H&S pattern. If POPCAT breaches this level and closes a daily candle below it, there is a strong possibility that the coin could decline by more than 20% in the coming days.

However, this bearish thesis will only hold if POPCAT closes a daily candle below the $1.15 level, otherwise, it will be invalidated.

Bearish On-Chain Metrics

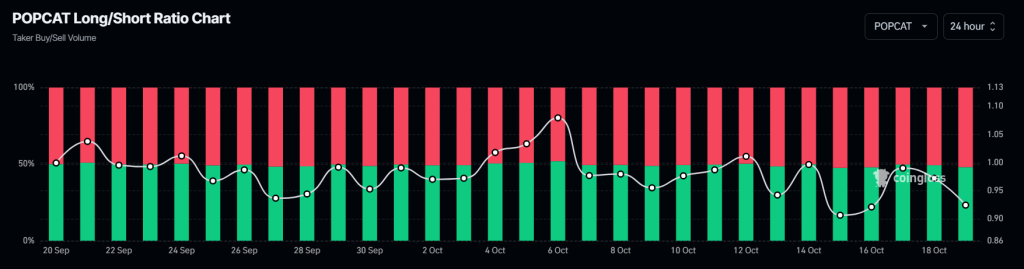

On-chain metrics further support POPCAT’s negative outlook. According to the on-chain analytics firm Coinglass, POPCAT’s Long/Short ratio currently stands at 0.92, indicating a strong bearish sentiment among traders. Additionally, its open interest has dropped by 7.9% over the last 24 hours and 3.5% over the past four hours.

This decline in the meme coin’s open interest suggests that traders are either exiting their positions or facing potential liquidation due to the ongoing price decline.

Combining these on-chain metrics with technical analysis, it appears that bears are currently dominating the asset and could drive its price decline in the coming days.

POPCAT’s Current Price Momentum

At press time, POPCAT is trading near $1.28 and has experienced a price decline of over 7% in the past 24 hours. During the same period, its trading volume dropped by 40%, suggesting lesser participation from investors and traders, likely due to the formation of bearish price action.