Will It Spark Price Volatility?

Over $2.5 billion worth of Bitcoin and Ethereum options contracts are set to expire this Friday. Moreover, markets are still reeling from US economic data this week, including CPI and PPI, but can the derivatives’ expiry event today push prices higher over the weekend?

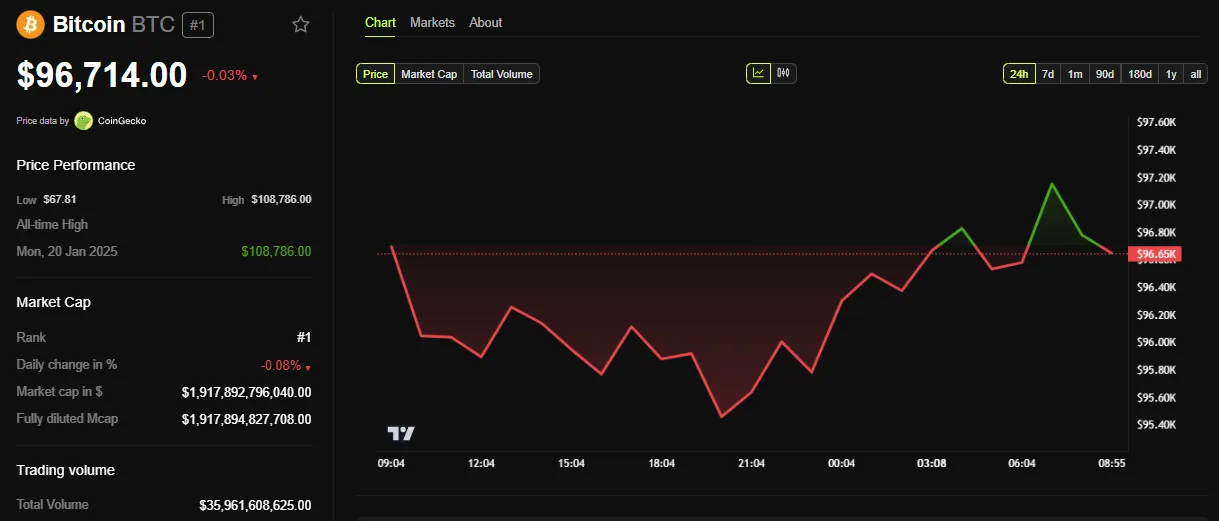

Bitcoin (BTC) remains well below the $100,000 psychological level as the influence of macroeconomic events continues to drive sentiment.

Bitcoin and Ethereum Options Expiring Today

Around 21,362 Bitcoin options contracts will expire on Valentine’s Day, February 14. The notional value for this Friday’s tranche of expiring Bitcoin options contracts is $2.07 billion, according to data on Deribit. The put/call ratio is 0.66, suggesting a prevalence of purchase options (calls) over sales options (puts).

As the Bitcoin options expire, they have a maximum pain or strike price of $98,000, at which point the asset will cause financial losses to the greatest number of holders.

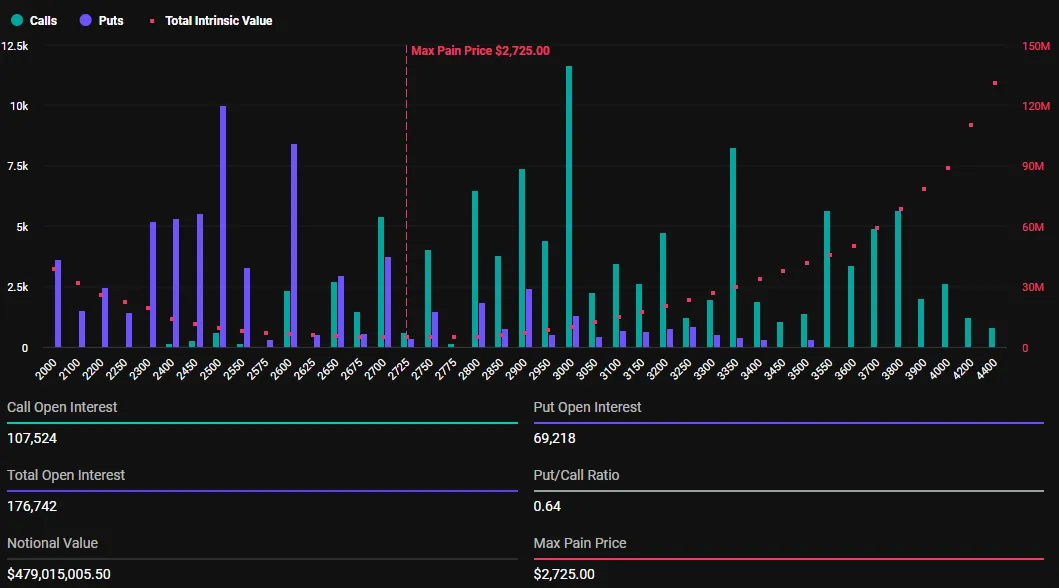

Similarly, crypto markets will witness the expiry of 176,742 Ethereum contracts, with a notional value of $479.01 million. The put-to-call ratio for these expiring Ethereum options is 0.64, with a maximum pain of $2,725.

This week’s options expiry event is much smaller than what crypto markets witnessed last week on Friday. As BeInCrypto reported, approximately $3.12 billion worth of BTC and ETH options expired then, ascribed to US President Donald Trump’s tariffs, which stunted Bitcoin price below $100,000

Options expiry could lead to price volatility, so traders and investors need to monitor today’s developments closely. Nevertheless, put-to-call ratios below 1 for Bitcoin and Ethereum in options trading indicate optimism in the market. It suggests that more traders are betting on price increases.

Market sentiment maintained a weak consolidation this week, commented Greeks Live, which added that implied volatility fell to its lowest level in almost a year despite multiple positive news from the US government side. This signals lower expected price swings that can affect options pricing and trading strategies.

“Since BTC effectively fell below the $100,000 mark, options majors have been consistently selling short- and intermediate-term calls, with a significant increase in Block call trading volume but a decline in Block put volume, suggesting that while the market isn’t bullish on the upside, it’s just as panicked about the downside,” Greeks.live shared.

Against this backdrop, analysts at Greeks.live indicate that institutions view February as a ‘junk time.’ This means a period of low market activity or interest could impact trading volumes and crypto market prices.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices could approach their respective maximum pain points. According to BeInCrypto data, BTC traded for $96,714, whereas ETH exchanged hands for $2,696.

This suggests that BTC and ETH prices might rise as smart money aims to move them toward the “max pain” level. According to the Max Pain theory, options prices tend to gravitate toward strike prices where the highest number of contracts, both calls and puts, expire worthless.

Price pressure on BTC and ETH will likely ease after 08:00 UTC on Friday when Deribit settles the contracts. However, the sheer scale of these expirations could still fuel heightened volatility in the crypto markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.