MicroStrategy shareholders will vote on proposals to boost stock issuance for Bitcoin strategy

Key Takeaways

MicroStrategy shareholders will vote on increasing the authorized common stock to 10.3 billion shares.

The vote will consider amendments to the company’s equity incentive plan and procedural changes for board directors.

Share this article

MicroStrategy shareholders will vote on key proposals to boost authorized shares and revise the equity incentive plan—a strategic move in support of the company’s Bitcoin strategy.

“The proposals we are asking you to consider reflect a new chapter in our evolution as a Bitcoin Treasury Company and our ambitious goals for the future,” MicroStrategy co-founder and executive chairman Michael Saylor stated.

The vote is set to take place at a special meeting in 2025; the exact date will be disclosed subsequently, according to a recent notice filed with the SEC.

The meeting, to be held via webcast, will allow stockholders of record as of a to-be-determined date in 2025 to vote on four proposals, including increasing common stock to 10.3 billion shares from 330 million and preferred stock to 1 billion shares from 5 million.

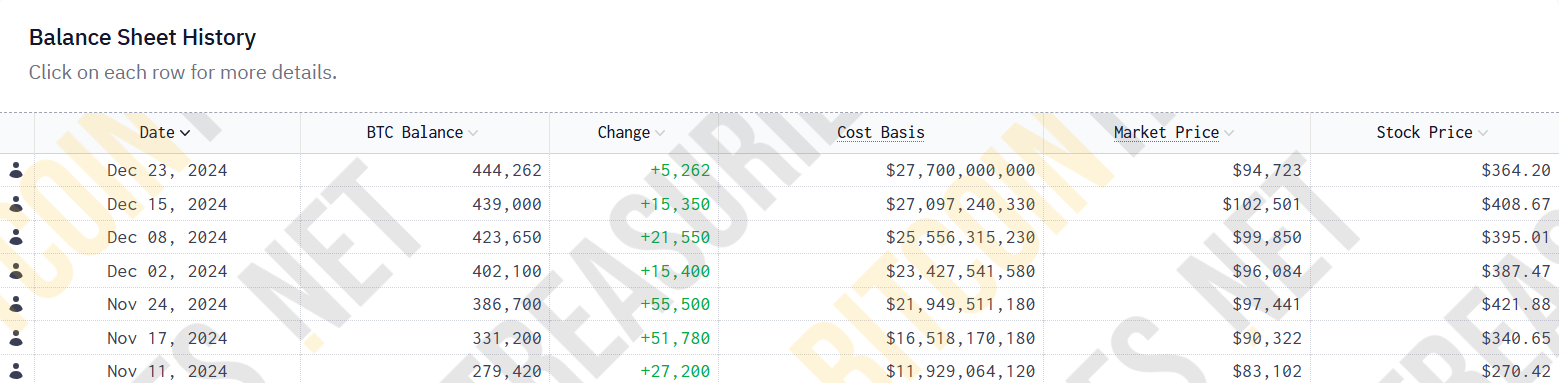

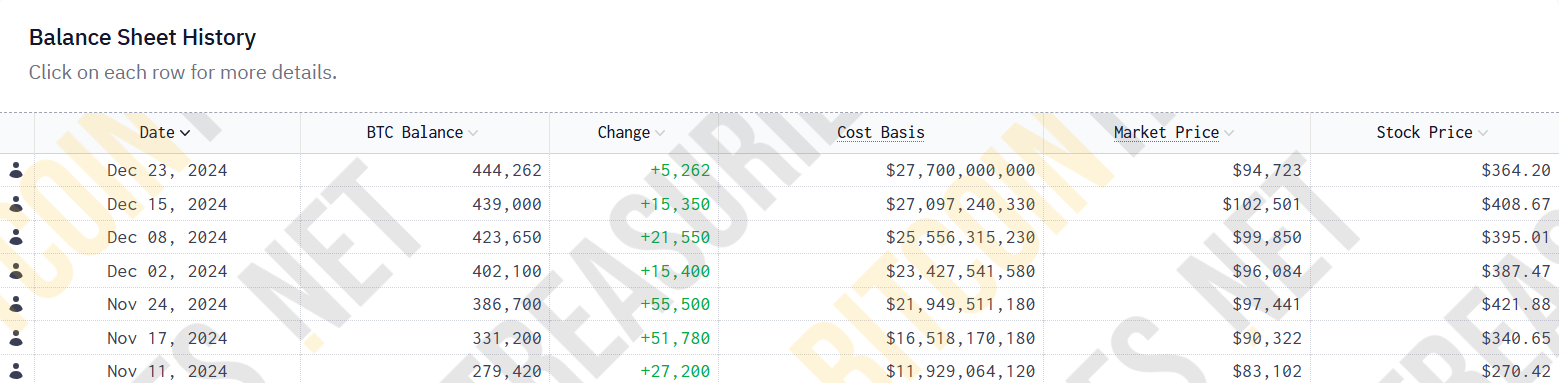

The proposed expansion is aimed at supporting the ’21/21′ plan which involves raising $42 billion to fund future Bitcoin acquisitions in three years. Saylor said last week the company would re-evaluate its capital allocation strategy once the $42 billion target is met.

Since announcing its plan, MicroStrategy has acquired around 192,042 BTC worth around $18 billion. This means it has achieved approximately 42% of its planned investment goal in less than two months.

The Virginia-based company also seeks stockholder approval to amend its existing equity incentive plan. If approved, the amendment will automatically grant three newly appointed directors—Brian Brooks, Jane Dietze, and Gregg Winiarski—equity awards valued at $2 million upon their initial appointment to the Board.

This proposal reflects the company’s strategy to attract and retain qualified directors as it continues to focus on its Bitcoin acquisition strategy.

Shareholders will also decide on a procedural measure allowing for meeting adjournment if there are insufficient votes to approve any proposals, enabling additional vote solicitation if needed.

MicroStrategy’s proposals come after its inclusion in the Nasdaq-100 index took effect on December 23. The move is expected to lead to increased buying from index-tracking funds, such as the popular Invesco QQQ Trust, which could enhance MicroStrategy’s stock liquidity and visibility among investors.

Share this article